For accredited investors only

This website is intended for use by Accredited investors (as such term is defined in the Securities Act (Ontario) or National Instrument 45-106 - Prospectus Exemptions, as applicable) resident in, or otherwise subject to the securities laws of, any province or territory of Canada, or pursuant to such other exemptions from the prospectus requirements under applicable securities legislation.

Examples of who qualifies as an accredited investor:

- an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that, before taxes but net of any related liabilities, exceeds $1,000,000;

- an individual who beneficially owns financial assets having an aggregate realizable value that, before taxes but net of any related liabilities, exceeds $5,000,000;

- an individual whose net income before taxes exceeded $200,000 in each of the two most recent calendar years or whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the two most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year;

- an individual who, either alone or with a spouse, has net assets of at least $5,000,000;

- a person (other than an individual or investment fund) that has net assets of at least $5,000,000 as shown on its most recently prepared financial statements provided that such person has not been created solely to purchase or hold the Units being purchased; and

- a person acting on behalf of a full managed account managed by that person, if that person is registered or authorized to carry on business as an adviser or the equivalent under the securities legislation of a province or territory of Canada or a foreign jurisdiction.

"Financial assets" generally means cash and securities and "related liabilities" means liabilities incurred or assumed for the purpose of financing the acquisition or ownership of financial assets, or liabilities that are secured by financial assets.

This website is not intended to constitute an offer of units of Fidelity Alternative Real Estate Trust (the "Fund"). The information contained herein is qualified in its entirety by reference to the Offering Memorandum ("OM") of the Fund. The material available on this website is published for informational purposes only. It does not constitute a solicitation of an offer to buy or an offer to sell securities, nor should the information be relied upon as investment advice. Units of the Fund are generally only available to Accredited Investors (as described above). The OM contains information about the investment objectives and terms and conditions of an investment in the Fund (including fees) and also contains tax information and risk disclosures that are important to any investment decision regarding the Fund.

Money Gains: Lesson plans

Our team of experts have diligently crafted comprehensive lesson plans and supplementary materials for your students’ benefit!

Chapter 1: Investing concepts

Choose between two tailored lesson plans designed to equip you with the necessary resources to teach your students.

Please note: PowerPoints will automatically download when clicked.

Lessons 1&2:

The difference between saving and investing

Take a closer look at saving vs. investing and how to make your money grow!

Lessons 3&4:

Asset classes

Different types of investments can give you different results. Learn about what asset classes are, and why they matter.

Lessons 5&6:

Setting goals and time horizons

When it comes to investing, time is money. Learn about what this means and why it’s important.

Lessons 7&8:

The power of compounding

The real secret to making your money work for you. Learn about what you can do to keep the momentum going.

Lessons 9&10:

Understanding your investment returns

Knowledge is power! So is understanding how much cash you’ve earned after investing.

Lessons 11&12:

Understanding investment risk

Greater risk can mean greater rewards (or greater losses). Find out why it’s important to consider risk when investing.

Lessons 13&14:

Risk and return expectation

There's no such thing as a free lunch. Understand the potential risk you may need to take to achieve certain investment returns.

Lesson 15&16:

Common investing pitfalls

Mistakes happen - even for experienced investors. We’ll walk you through the most common investing mistakes and how to avoid them.

Students will demonstrate their understanding of budgeting principles and financial management skills and the ability to apply financial concepts to real-life scenarios. They will demonstrate preparedness to make informed financial decisions in their personal and future professional lives.

Chapter 2: Building an investment portfolio

Choose between two tailored lesson plans designed to equip you with the necessary resources to teach your students.

Please note: PowerPoints will automatically download when clicked.

Lessons 1 & 2:

What are capital markets?

Get familiar with a company’s capital structure and what types of funding may be available.

Lessons 3 & 4:

How do stock markets work?

Dive into the world of stock markets and learn about supply and demand, market sensitivities and more!

Lessons 5 & 6:

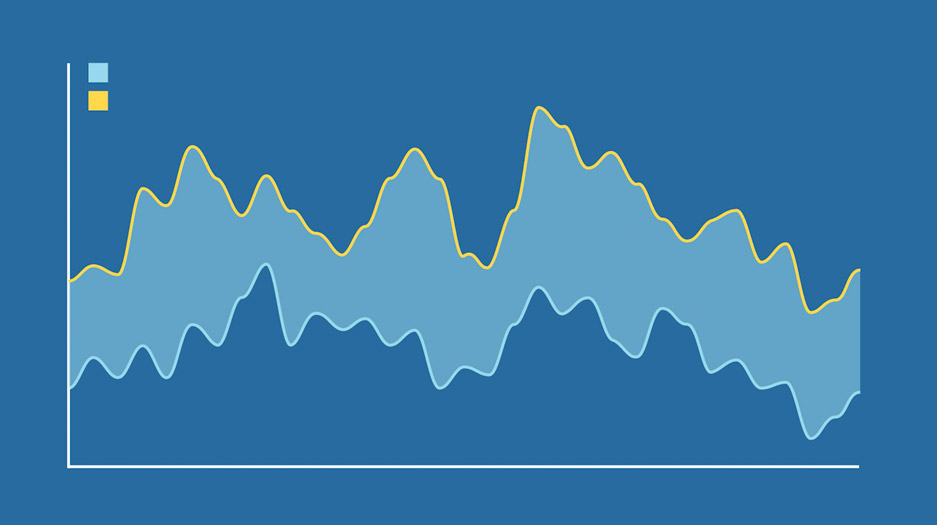

What affects returns for bonds?

Interest rates and credit spreads are just the tip of the iceberg for what could affect potential returns from bonds.

Lessons 7 & 8:

Types of securities

Learn about what securities are, and why they matter.

Lessons 9 & 10:

How do bond markets work?

You’ve heard about stock markets, but what about bond markets? In this video, we’ll cover general topics such as monetary vs. fiscal policy, demographics and much more!

Lessons 11 & 12:

Breaking down asset classes

Part two of asset classes! You’ll learn what a factor is and break down asset classes even further.

Lessons 13 & 14:

ESG and sustainable investing

Understand the sustainability and ethical impact of your potential investments.

Lessons 15 & 16:

What affects returns for specific stocks?

Find out what factors could potentially affect returns from certain stocks.

Lessons 17 & 18:

The impact of foreign exchange rates

As a Canadian investor, it’s important for you to know how to protect your potential returns from the impact of currency fluctuations from foreign investments.

Lessons 19 & 20:

Types of security analysis

Get familiar with the main differences between fundamental analysis and technical analysis. We’ll share some examples of each and cover valuation models.

Students will demonstrate their understanding of building an investment portfolio. Their evaluation will be based on their ability to make informed financial decisions applicable to both their personal lives and future professional careers.