Making sense of duration sensitivity: Bond duration explained

When it comes to bonds, what’s the first thing that springs to mind when you see the word “duration”?

You’d be forgiven for thinking that duration refers to the length of bond – perhaps the “life” of the bond, or the number of years before it is repaid. However, bond duration is a little more complex than that.

The meaning of duration

Duration is a measure of the sensitivity of a bond, or a portfolio of bonds, to changes in interest rates (interest rate risk). Duration calculations are used extensively by fixed income investors, given the close relationship between interest rates and bond prices. As you may already know, interest rates and bond prices have an inverse relationship: that is, when interest rates rise, the price of bonds will fall – and vice-versa.

Interest rates, often referred to as the cost of borrowing, are set by central banks and are one of the tools used to promote growth or to control inflation in an economy. If a central bank is seeking to stimulate an economy, it may lower interest rates to encourage more borrowing and, as a result, more spending. However, this action would also cause the price of the country’s bonds to fall.

Now, imagine that you’re a fund manager in charge of a portfolio of bonds. Wouldn’t it be really useful to know how sensitive your holdings are to changing interest rates? That is why understanding duration is so important.

Putting duration to work

Most professional bond investors will have a view on the health of the economy, and the future path of interest rates, in the markets in which they invest. They may use allocations based on duration to express these views in a fixed income portfolio.

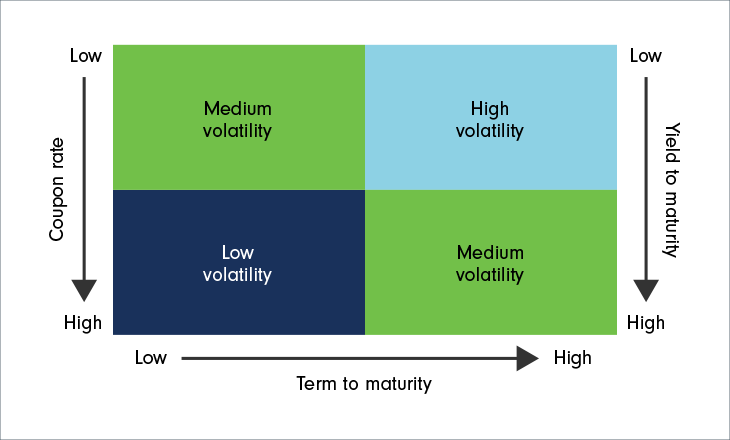

Generally speaking, longer-dated bonds with low coupons will have longer durations. The longer the bond’s maturity, the more time there is for interest rates to change and affect the bond’s price.

On the other hand, bonds with shorter maturity dates or higher coupons will have shorter durations, as they are less sensitive to changing interest rates.

Understanding duration

For illustrative purposes only.

If investors expect interest rates to fall (which means bond prices should rise), they are likely to build a more interest rate-sensitive portfolio of higher-duration bonds.

In contrast, investors who anticipate rising rates would probably want to mitigate the effects on their portfolio. To do so, they are likely to prefer shorter-duration bonds – those with high coupon payments and shorter maturities.

Calculating duration

Investment professionals use duration because it helps to distill several features of bonds, such as maturity date and coupon payments, into one number that shows how sensitive a bond's price is to interest rate changes.

It’s possible to calculate the duration of both individual bonds and a portfolio of bonds. Two commonly used methods are simplified duration (also known as Macaulay duration) and modified duration.

While duration is a very useful measure for assessing interest rate risk in a fixed income portfolio, it’s important to remember that there are other factors to consider. Credit risk, inflation risk and liquidity risk are just some of the things you need to consider when considering a fixed income investment.