Introduction to Bitcoin

What is Bitcoin?

Bitcoin1 is a digital asset that can be transferred on a peer-to-peer basis via the Bitcoin network. The Bitcoin network is a network of computers, called “nodes”, running Bitcoin software that are connected via the Internet. The idea for Bitcoin was proposed in a white paper released in 2008, published under the pseudonym “Satoshi Nakamoto.”

What is blockchain?

Traditionally, trusted central parties (e.g. banks) are needed to verify and maintain a record of everyone’s transactions. However, there is no single centralized party that administers or keeps a central record of bitcoin transactions. Instead, bitcoin transactions are recorded in a decentralized manner. All bitcoin transactions are communicated to all nodes on the Bitcoin network, and all nodes on the network keep their own copy of the transaction ledger2.

FIGURE 1: Centralized vs. decentralized transaction records

For example, if Alice wants to send Bob 10 bitcoin, this proposed transaction would be communicated across the Bitcoin network. Valid transactions must contain a digital signature of the spender, which cannot be reasonably forged3, thus preventing someone else from spending Alice’s bitcoin.

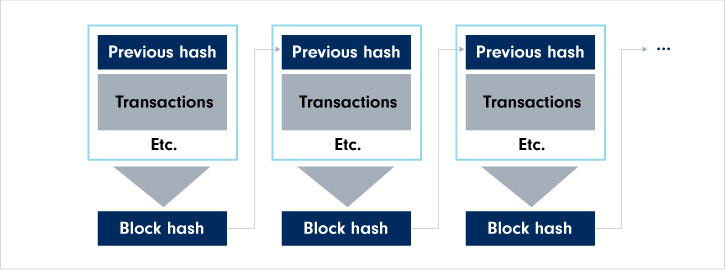

Every so often, a bunch of the latest proposed transactions are collected together in a block and added to the existing chain of blocks of transactions -- this is called a “blockchain”. Over time, the number of blocks in the blockchain grows as more transactions are added. Each block is linked to the next, as each block contains a cryptographic footprint, called a “hash”, of the previous block’s contents. This allows the blocks of transactions to be locked into a permanent, unchangeable order.

FIGURE 2: Ordered chain of transaction blocks

Copies of the Bitcoin blockchain exist on thousands of computers across the Bitcoin network.

What is bitcoin mining?

Mining, also called “proof-of-work”, is the mechanism through which the Bitcoin network seeks to maintain the consistency and integrity of its blockchain. In other words, it’s a way to make sure that everyone on the network can agree on what the blockchain should look like.

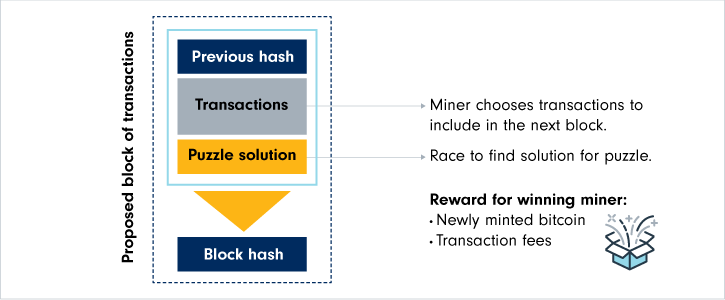

In order to reach agreement on the next block of bitcoin transactions to be added to the blockchain, certain people called “miners” compete with one another to find the solution to a cryptographic puzzle. The first miner to find an answer proposes the next block of transactions to add to the blockchain by broadcasting their proposed block to the entire network. Nodes on the network then validate and add this proposed block to their existing blockchain. The winning miner gets an award of newly created bitcoin for their efforts and also gets to collect any transaction fees for the transactions contained in the block they propose.

The puzzle can only be solved by brute force computing power. Specifically, it involves finding a special attachment to append to a given block of transactions, such that the resulting cryptographic footprint of the block’s contents satisfies a certain condition. As the total mining power of the network grows and fluctuates over time, the difficulty of solving this puzzle is adjusted periodically such that the average time it takes to arrive at an answer remains at around 10 minutes (for Bitcoin).

FIGURE 3: Each miner seeks to propose the next block of transactions to the network

The double-spending problem

Why use such a computing-heavy method to reach agreement on transaction blocks? The reason is that this provides a way to deter bad actors and enhance the security of the network. One of the major issues proof-of-work addresses is called the “double-spending problem”.

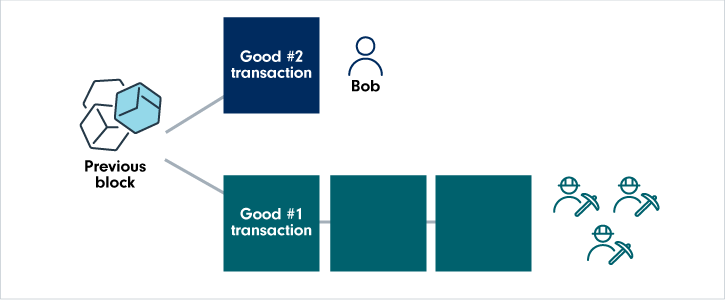

To see how this works, let’s consider Bob, who is a bitcoin miner. Bob transfers bitcoin to pay for good #1 by signing and broadcasting this transaction to the network. This transaction gets included in the next block by a miner, and after a few more blocks are mined, Bob receives good #1 from the merchant. Bob then tries to double-spend the coins he has already spent on good #1 to buy good #2.

In order to do this, Bob would need to start a competing branch of the blockchain, as illustrated in Figure 4. However, there’s a rule on the Bitcoin network that says that everyone on the network should trust and build on the longest chain at any given time. This means that all the other miners on the network are building on the chain containing the good #1 transaction, because it is longer. Thus, unless Bob has over half of the computing power of the network (which would be very costly), the chance that he can mine blocks quickly enough to eventually outpace the other chain becomes negligible.

FIGURE 4: There’s a rule to trust the longest chain

Value proposition of Bitcoin

Bitcoin serves as an alternative monetary system to traditional, centralized systems. It can be used as a currency or as a story of value in situations where people do not wish to rely on their government or traditional institutions. This could include situations relating to geopolitical crisis, war, hyperinflation, fiat currency devaluation, capital controls, privacy protection, and so on.

Bitcoin has been compared to gold as a potential transnational store of value. Bitcoin presents several other characteristics that may make it favourable as a transnational store of value.

Self-custody

Users can choose to custody their own bitcoin, without needing to rely on a third-party custodian. Compared to gold, bitcoin is generally more easily transferrable and verifiable, and is easier and cheaper to store.

Security

As the Bitcoin blockchain is decentralized, it possesses no central point of vulnerability, making it difficult to attack and resistant to seizure by any government or entity. In addition, the underlying protocol has a strong track record in terms of security. Since Bitcoin launched in 2009, the network has never been hacked (i.e., has never been subject to a “51% attack”).

Large network effects

Bitcoin currently leads global cryptocurrency market by market share4. The total computational power securing the Bitcoin network is many times more than that of the top 500 supercomputers in the world combined. Over the years, many other blockchain networks have emerged, many of which seek to expand on Bitcoin’s capabilities. However, it’s important to note that Bitcoin’s relative simplicity is by design, and aimed at encouraging better decentralization and security.

Scarcity

Since launch, the issuance rate of new bitcoin has decreased over time and will continue to decrease in the future. Bitcoin’s hard cap supply limit of 21 million coins is coded into its core protocol. Around every four years (every 210,000 blocks), there is a halving of the block reward received by miners. The third, most recent, halving occurred on May 11th, 2020, which dropped the block reward from 12.5 to 6.25 bitcoin. At this rate, the hard cap limit is expected to be achieved in the year 2140.

Risks

Bitcoin has historically been a highly volatile investment, and may not be suited for all investors. The optimal portfolio allocation to bitcoin depends on the nature of the investor’s existing portfolio, investment objectives, risk tolerance and specific investment circumstances. When considering an investment in bitcoin, it is important to remember that although bitcoin may, at the time of investment, present certain characteristics that may make it favourable as a store of value, there is no guarantee that it will succeed as an actual store of value in the future. The valuation of bitcoin, both on an absolute basis as well as relative to other currencies, including fiat currencies, is difficult to evaluate in general.

The future of bitcoin and the Bitcoin network, which is part of a new and rapidly changing industry, is subject to a variety of factors that are difficult to evaluate. Going forward, competitive pressures and/or technological, regulatory or other developments may result in increased volatility and/or a reduction in the price of bitcoin. Blockchain technology as a whole may face challenges that act to hinder its adoption and development, which may have negative repercussions for bitcoin and the Bitcoin network. Investors should discuss the specific risks of potential investments with their financial advisor in advance of purchase.

Introducing Fidelity Advantage Bitcoin ETF® and Fidelity Advantage Bitcoin ETF Fund® →

When investing in bitcoin, safeguarding private keys is of the utmost importance to protect against the loss of funds. Fidelity Advantage Bitcoin ETF® and Fidelity Advantage Bitcoin ETF Fund® offer Canadian retail investors the opportunity to gain exposure to bitcoin via familiar, easy-to-trade, RRSP- and TFSA-eligible vehicles, that are backed by institutional-grade custodial services through the funds’ relationship with Fidelity Clearing Canada and Fidelity Digital Assets to keep the funds’ bitcoin safe.

1We refer to the Bitcoin network, protocol and system as a whole as “Bitcoin.” We refer to the system’s unit of account, BTC, as “bitcoin.”

2For ease of explanation, some simplifications are introduced. The difference between full and light nodes is not discussed here.

3The mathematical details, while fascinating, are beyond the scope of this paper.

4As of the time of writing.

5 Automatic, self-executing contracts that live on a blockchain.