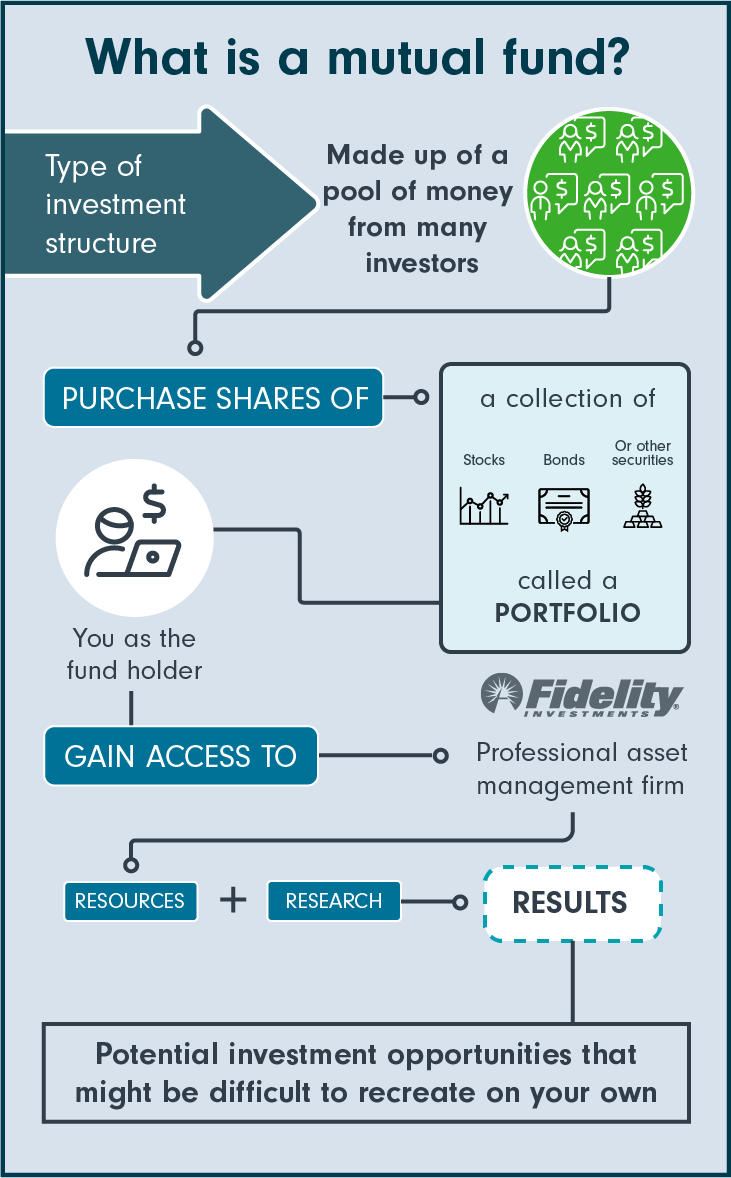

What is a mutual fund?

| Tip | In any investment you make, there is a trade-off between risk and return. A fund that promises the potential of higher returns usually comes with higher risk. On the flip side, a fund with a low risk level might not deliver returns that are high enough to help you reach your financial goals. The right type for you may depend on your tolerance for risk and your personal investment goals. |

How do mutual funds work?

Mutual funds are a practical, cost-efficient way to build a diversified portfolio of stocks, bonds or short-term investments. Most mutual funds invest in asset classes such as equities (stocks and shares) and/or bonds (fixed income), but they can also invest in commodities, real estate and other investments.

| Investment pool A mutual fund is an investment that pools together money from individual investors to buy asset classes such as stocks, bonds and other securities to perform as one investment. |

|

| Professionally managed

As a mutual fund investor, you get the benefit of having professional money managers who have the expertise and resources needed to

|

|

| Diversification Buying shares in a mutual fund can help diversify your investments; most mutual funds hold well over 100 securities. Building and managing a portfolio containing that many securities could potentially be highly impractical, if not impossible. But remember, diversification does not ensure a profit or guarantee against loss. |

|

| Purpose-built Each fund will have a stated objective that the portfolio manager will work to deliver for investors. For example, if you’re mainly interested in growing the value of your assets, you could pick a fund dedicated to capital growth. |

| Tip | The idea of a mutual fund is to bring together lots of different investments into one structure in order to help investors get as much value for their money as possible, and to help them achieve their investment goals, in line with their time horizon and risk tolerances. For the average small investor, mutual funds can be a smart and cost-effective way to invest. Individual purchase minimums vary by fund, but can be as low as $100. |