Three ways a financial professional can add value

Based on an article from our U.S. partners

Getting help to invest, manage taxes and protect your family may be worth the cost.

The financial world is complex, with myriad choices, complex terminology and high stakes. Many people prefer a do-it-yourself approach, but partnering with a financial advisor has the potential to help. Of course, that guidance comes with a cost. Is it worth it? That is a personal decision that each individual needs to evaluate, but there are advantages to working with a financial advisor.

“Having a strong relationship with a financial advisor can be a huge benefit for individuals and the people they care about,” says Peter Bowen, Vice-President, Tax and Retirement Research. “A financial advisor can help prevent you from being blindsided by risks, avoid making big mistakes, understand your options and confront realities about your financial situation. They also help you to make strong plans, factoring in all of your circumstances, including your goals and tax situation.”

1. Investment guidance

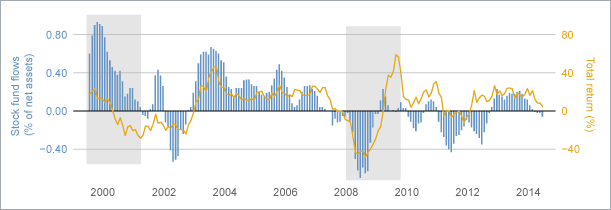

The nightly news will always include a mention of what the S&P/TSX or Dow Jones Indexes did. While these broad benchmarks have a role to play in evaluating investment returns, the truth is that most investors fall far short of “market” performance. Independent research firm DALBAR estimates that the average stock investor in the U.S. trails the stock market by nearly four percentage points annually, while Morningstar has estimated that mutual fund investors as a whole have trailed the average mutual fund by from 0.55% up to 2.5% a year, in recent years.1 One key reason: bad timing.

Investors as a whole tend to buy investments that have been rising and sell when they have been falling, as the emotions of fear and greed drive decisions. Unfortunately, these are often poorly timed decisions, and they end up resulting in underperformance.

A financial advisor potentially can help you create and follow a disciplined investment process to avoid these emotional decisions. This includes an appropriate asset allocation to help you reach a particular goal. Research has shown that asset allocation is a key driver of portfolio returns. The choice of an appropriate asset allocation depends on your goal, time frame, situation and risk tolerance. But it’s not easy to do. According to data from workplace savings plans that Fidelity administers in the U.S., only about half the investors who are doing it on their own have an asset allocation that is roughly on track.2

Having an appropriate investment mix is important when it comes to how much risk and volatility you can tolerate. The key is to pick a portfolio mix you can stick with through market ups and downs.

“Acting on our emotions rarely produces the best financial results,” says Bowen. “An experienced financial advisor can offer a steadying hand during stressful times to help you stick to a plan that’s right for your situation and feelings about risk, and to navigate the markets to reach your goals.”

2. Navigating the tax rules

Taxes, and all the rules around taxes, are complicated, but a financial advisor may be able to help.

Just helping you to think through which of your investments should be held in which account can make a big difference. Which investments are better suited for a TFSA and which for a registered retirement savings plan? Because different types of investments are subject to different tax rules, and different types of account offer different tax benefits, coming up with a strategy for what to put where can potentially reduce the taxes you have to pay on your investments overall. These asset location decisions can be complex, but a financial advisor may be able to help.

“A financial advisor can help manage your long-term tax situation, which can be critical to maximizing cash flow, especially as you move into retirement,” says Bowen.

3. Financial planning for life

Having a relationship with a financial advisor also creates the opportunity for you to manage the risks and needs of your family as they change over time. This means everything from a plan for retirement saving to managing the financial impact of children and parents through different life stages, and protecting your own long-term financial goals from excessive risk.

A financial advisor can help you manage the complexities of retirement savings and spending: choosing how much to save and in which accounts, and then how much to withdraw, and which investment alternatives and accounts should be used to help generate income.

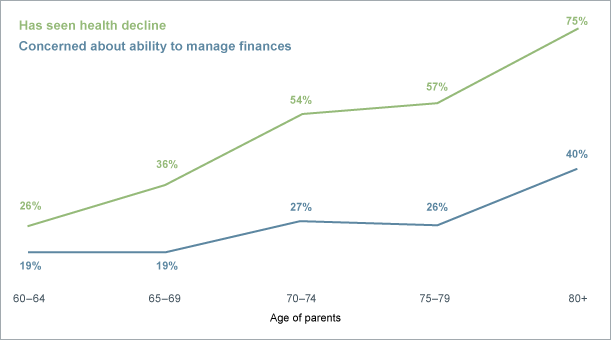

A financial advisor can also help keep your plan on track, by helping to manage changes in your life, and helping to navigate around major risks. This means helping you adjust your strategy to support your children – and your aging parents – through the different stages of life. It also means helping to protect your family from major risks. Health issues are a common cause of early retirement, and they can derail your plans. A financial advisor can help you to create a plan to protect your loved ones.

A trusted financial advisor can also help your family. In many families, a single individual is primarily responsible for investment decisions and managing money. But as you age, the risks of disability, impairment and death rise. It may not be pleasant to consider, but who would help your spouse or children navigate your financial situation if you couldn’t?

Working with a trusted financial advisor who understands your financial situation can help your loved ones manage that transition. A financial advisor can also bring an impartial perspective to challenging family conversations, including who will make decisions and what will happen to your money after you are gone.

“Our research in the U.S. shows that seven in ten adult children believe it is important to know about their parents’ financial situation, and one in three feels he or she needs to know more,” says Bowen.3 “A financial advisor can assist in these conversations and step in during the moments that matter, with the information and insight you and your family need to handle changes as you age.”