Can you time the stock market?

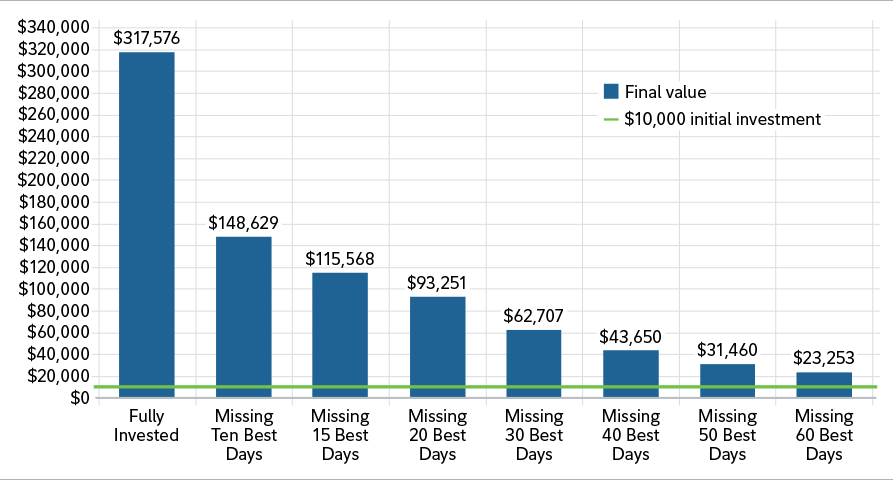

Don’t miss out on the market’s best days.

What does “buy low, sell high” mean? Simple: you buy investments when their price is down and sell them when their price has peaked. Except without a crystal ball, it’s impossible to predict when those prices will occur. How do you know when a share price is going to peak? How do you know that the price won’t keep rising?

The costs of getting it wrong are high. You may miss out on positive returns and big gains for your portfolio if you pull out of your investments too early.

Let’s look at an example. The graph below shows what could happen if you stay invested in an S&P/TSX composite index fund. You may generate strong returns, compared with losing money if you miss 60 of the market’s best days.

Source: LSEG DataStream. Index total returns from January 1, 1986 to December 31, 2025.

On the flip side, imagine if markets start to go down and you sell your investments before they rapidly go back up. If the stock markets quickly go up and you want to invest again, you would have to buy back those stocks at a higher price than you initially paid for them, which means you may lose money. Every time you buy and sell, you pay commission fees – and you risk missing out on the market’s best days. That is because markets are volatile.

Markets can fluctuate quickly. For an average investor, it’s hard to know when that will happen. It’s important to consider the benefits of staying fully invested.

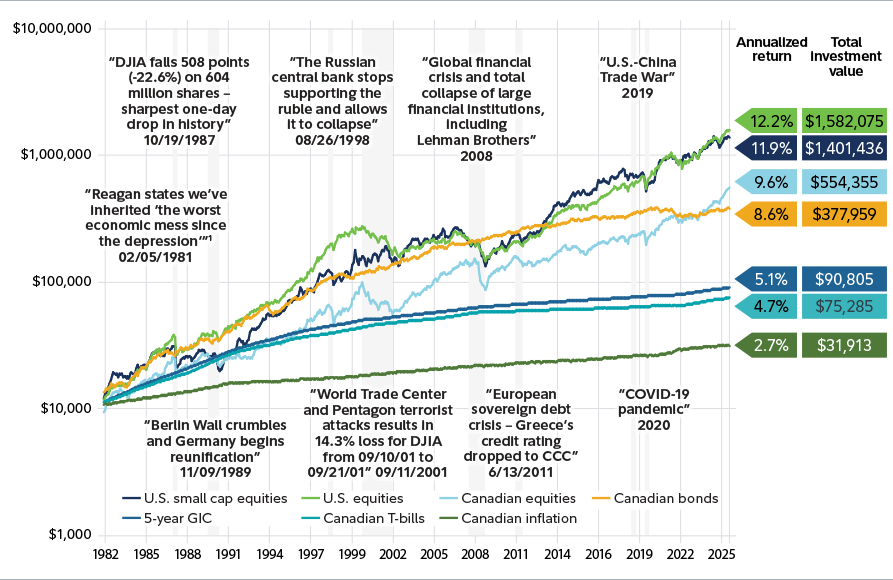

Many events have affected markets in the past; however, over the long term, markets have historically bounced back. Investors who stayed the course increased their wealth – below you can see the potential for growth the longer you stay invested.

December 31, 1981, to December 31, 2025, inclusive.*1 Address to the Nation on the Economy, February 5, 1981.

The graph represents an investment of $10,000 in stocks, bonds and cash (as indicated above), and accounts for inflation from December 31, 1981, through December 31, 2025. The compound growth calculations shown are used to illustrate the effects of the compound growth rate and is not intended to reflect future values of the fund or returns on investment in any fund. All indicated returns are total returns in Canadian dollars as at December 31, 2025. It is not possible to invest directly in an index. Indexes are not managed and do not have management fees and expenses.

Sources: Morningstar, DataStream, TSX Group, Bank of Canada, Department of Monetary and Financial Analysis and Fidelity Investments Canada ULC. Indexes used: U.S. small-cap equities: IA U.S. Small Stock Index(US$); U.S. equities: S&P 500 Index (US$); Canadian equities: S&P/TSX Composite Index; Canadian bonds: FTSE Canada Universe Bond Index; Canadian five-year GIC: chartered bank-administered rates; Canadian T-bills: FTSE Canada 91-Day T-Bill Index; inflation: Canadian consumer price index.