Introduction to Ethereum

Meghan Chen, MFE, CFA | Digital Assets Strategist

Written: July 2022

Note that since this article was written, Ethereum successfully completed the transition to proof-of-stake consensus on September 15, 2022.

This article is Part 1 of a five-part series that aims to provide an overview of the Ethereum network from an investment perspective. The first part provides some background on the mechanics of Ethereum, and then outlines its general value proposition and competition positioning. The second, third and fourth parts each focus on a key aspect of the ecosystem of applications that may be built on Ethereum, and aim to provide insight with regard to use cases, growth metrics and considerations. The fifth part examines the future of Ethereum from a broader perspective, and includes a discussion of its development roadmap, as well as different types of risks that may be associated with an investment in ether.

A brief review of blockchain

A blockchain network consists of a network of computers running the blockchain protocol software. These computers are known as “nodes.” Nodes process and record transactions on the blockchain network. This record takes the form of a chain of blocks (each block specifies a set of transactions) called a “blockchain.”

Transactions are propagated across the network, and nodes update the blockchain with blocks of transactions over time. Each block contains a cryptographic footprint of the previous block, such that the blocks forming the blockchain are locked into a specific order, and the data in any block cannot be changed without modifying all subsequent blocks. Nodes reach agreement on the series of blocks that constitute the blockchain via a “consensus mechanism.”

There are two main types of consensus mechanisms: proof-of-work (PoW) and proof-of-stake (PoS). In PoW consensus, participants called “miners” expend computing power for the chance to propose blocks and earn associated rewards. In PoS consensus, participants called “validators” stake tokens (typically, the network’s native token) for the chance to propose blocks and earn associated rewards.

Introduction to Ethereum

How is Ethereum different from Bitcoin?

Bitcoin, launched in 2009, was the first ever blockchain network to be established. Ethereum launched in 2015. Ethereum’s vision is very different from that of Bitcoin; while Bitcoin primarily aims to be a payments network, Ethereum aims to be a general platform for different applications.

Applications on blockchain networks, called “decentralized applications” (Dapps), are built from smart contracts. Smart contracts refer to algorithms that are executed on blockchain networks upon certain triggers. The programming language used to implement smart contracts on Bitcoin is limited by design, for security and decentralization reasons. Less programming flexibility means fewer potential security vulnerabilities, as well as making it less resource-intensive for people to run a Bitcoin node. Smart contracts are used in Bitcoin primarily to specify the spending conditions of payment transactions. By contrast, the programming language used for Ethereum smart contracts is “Turing-complete,” which broadly means that it can be used to code arbitrarily complex algorithms. This allows for smart contracts and Dapps on Ethereum to be very flexible in terms of what they can do.

| Bitcoin | Ethereum | |

|---|---|---|

| Native token | Bitcoin (RT) |

Ether (ETH) |

| Year launched | 2009 |

2015 |

| Conceived by | Satoshi Nakamoto (pseudonym) |

Vitalik Buterin1 |

| Description | Payment network |

Platform for decentralized applications |

| Smart contract programming language | Turing-incomplete |

Turing-complete |

| Tokens | BTC |

ETH, other fungible and non-fungible tokens |

| Current supply | 19 million (21 million hard cap) |

119 million (no hard cap) |

| Consensus mechanism | PoW |

PoW (transitioning to PoS) |

While bitcoin is generally the only token on the Bitcoin network, there are thousands of tokens on Ethereum, both fungible as well as non-fungible (see Part 3 – Introduction to NFTs), associated with various contracts and Dapps. Ether is the fundamental, or “native,” token of Ethereum, and is the token used to pay all transaction fees on the Ethereum network. Thus, the demand for ether is tied to overall network usage. Once Ethereum moves from PoW to PoS consensus (see Part 5 – Ethereum roadmap and risks), ether may also be a yield-generating asset and a means of participating in network security.

Transactions on Ethereum

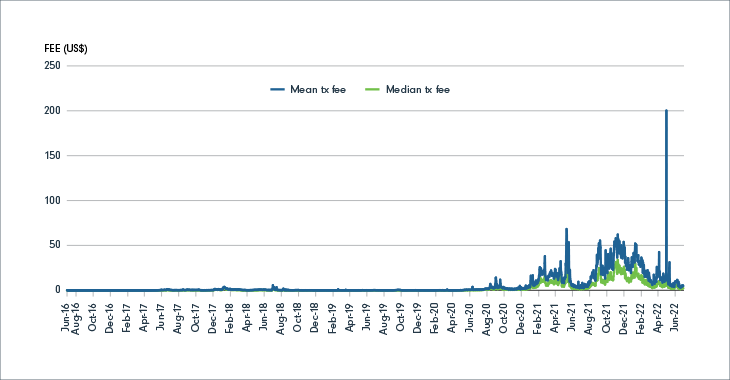

Transactions on Ethereum are processed by the Ethereum Virtual Machine, a computation engine. Transactions can range from simple transfers of ether to interactions with Dapps. As discussed, transaction fees are paid in ether. All else being equal, the more complex a transaction is, i.e., the more computational power that is required to process it, the higher the associated transaction fee, called a “gas fee.” Historically, gas fees on Ethereum have varied widely as a function of network demand. In times of high traffic, the network may become congested, and higher fees on average need to be paid in order to get transactions put through in a timely manner. For example, gas fees surged on May 1, 2022, due to high network traffic related to the sale of a series of non-fungible tokens by Bored Ape Yacht Club creator Yuga Labs.

FIGURE 1: Ethereum daily gas fees over time

Private keys

Much like on the Bitcoin network, tokens on Ethereum are linked with specific “addresses.” Transactions sent to the network to move tokens linked to an address must be signed with the private key (i.e., a cryptographic password) corresponding to the address.2 Anyone with an address’ private key has control of the funds associated with the address. Storage of cryptocurrency refers to the storage of private keys. Cryptocurrency wallets are special wallets that manage and store private keys.

Monetary policy

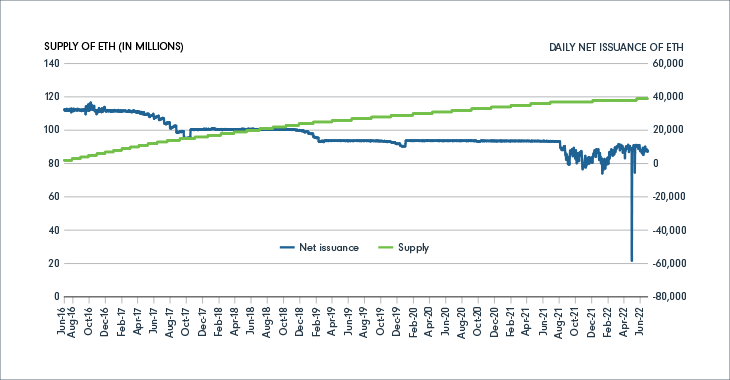

Ethereum’s original token distribution event occurred in 2014 and was managed by the Ethereum Foundation.3 It involved the sale of around 60 million ether to the public, as well as the allocation of 12 million ether to the Foundation and early Ethereum contributors.4 Thus, the total supply of ether at network launch was around 72 million. Over time, as additional ether was created and distributed via proof-of-work mining, the percentage of total supply controlled by the participants of the initial token distribution has decreased. Almost 50 million new ether has been issued since the launch of the network in 2015, resulting in a current total supply of ether of around 119 million (see Figure 2).

Unlike bitcoin, ether has no hard-capped supply limit. Currently, the supply is up around 2.6% compared with a year ago.5 The implementation of the London software upgrade in August 2021 introduced the burning (i.e., destruction) of a portion of coins paid as transaction fees, and thus decreased the net issuance rate. After Ethereum moves to PoS consensus, ether is expected to become non-inflationary or even deflationary, meaning that on average the amount of tokens destroyed will be equal or greater than the amount created (see Part 5 – Ethereum roadmap and risks).

FIGURE 2: ETH supply and daily net issuance over time

Value proposition of Ethereum

The principle of decentralization is at the core of public blockchains. There are several factors to consider when assessing the effective extent of decentralization of a blockchain network, such as the number of nodes, the extent of token distribution and the nature of the governance/development process. In practice, the extent of decentralization varies across blockchain networks. Scalability (i.e., processing more transactions quickly) is another top priority for many blockchain networks, which can encourage design choices that may hinder decentralization. In Part 5 – Ethereum roadmap and risks, we will discuss some of the solutions that Ethereum is working toward that aim to increase scalability.

Ethereum aims to offer a decentralized infrastructure on top of which various applications can be built. Potential advantages that public blockchain networks like Ethereum may provide include the following.

| Potential advantage | Description |

|---|---|

| Security |

|

| Transparency |

|

| Accessibility |

|

| Self-custody |

|

| Integration |

|

| Privacy |

|

*It should be noted that in practice, there could be high concentration of mining power or validator stake in the hands of relatively few parties.

†Users may, for convenience or other reasons, opt to have a third party custody their cryptocurrency.

Note: The above illustrates potential advantages that public blockchain networks like Ethereum may provide. Actual advantages may or may not include the above and may depend on the actual level of decentralization, as evaluated by several aspects, that Ethereum achieves. Blockchain is still an emerging technology, and it remains to be seen the long-term advantages it may bring.

Ethereum growth and competitive position

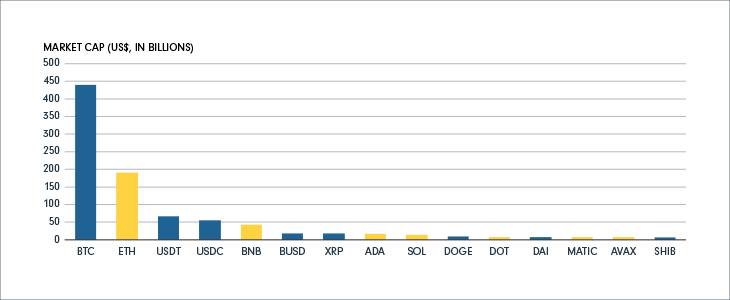

Ethereum currently leads major competitors, such as Solana, Cardano, Polkadot and Avalanche, by the market cap of its native token (see Figure 3). Ether is second only to bitcoin among all cryptocurrencies by market cap. Just as Bitcoin was a first mover as the first blockchain network to launch, Ethereum is a first mover in that it pioneered a more general type of blockchain.

FIGURE 3: Market cap of top cryptocurrencies

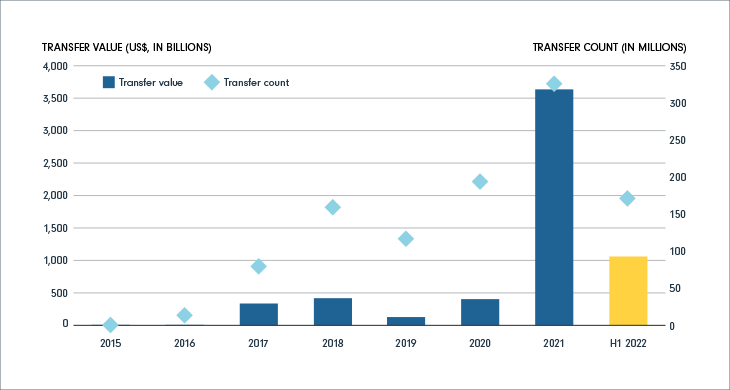

As a first mover, Ethereum has attracted a sizable number of users and developers to its ecosystem, establishing meaningful network effects. According to the 2021 Electric Capital Developer Report, Ethereum leads blockchain networks by the number of total developers, with more than 4,000 monthly active developers, and also attracts the largest percentage of all developers entering Web3.6 Ethereum also currently leads by DeFi activity (see Part 2 – Introduction to DeFi)7 and by NFT sales volume (see Part 3 – Introduction to NFTs). The charts below show the growth in transfer value and count on Ethereum over time.

FIGURE 4: Transfer value and count

Ethereum’s first-mover advantage and accompanying network effects support the extent of its decentralization relative to newer competitors. Currently, Ethereum has thousands of nodes operating around the world.8 Many newer blockchains may have more limited adoption in terms of nodes, users, validators, developers, etc., and thus may be relatively centralized. According to data from Coin Metrics, ether has a higher supply equality ratio compared with the native tokens of top competitor blockchains,9 which indicates that its supply is relatively more widely distributed. This will become especially relevant as Ethereum moves to PoS consensus, since in PoS, an entity’s impact on network security generally increases with the number of native tokens staked. The chart below illustrates that ether’s supply equality ratio has increased over time. It should be noted however, that ether supply is still highly concentrated in the top 1% of addresses, as measured by its supply equality ratio (see Figure 5).

FIGURE 5: Ether’s supply equality ratio

The relatively high transaction costs on Ethereum have contributed to the growth in adoption of alternative blockchains; however, as Ethereum works to improve its scalability as part of its roadmap, it may continue to consolidate its competitive position.