The value of active management

How investors can protect their money during periods of market volatility

There are two types of management styles for investments: active and passive. The former is common in mutual funds, which are typically sold through a financial advisor. The latter, often available through online brokerages, is common with index funds, which simply track broad market indexes. During market volatility, actively managed funds may offer more protection for your investments.

What is active management?

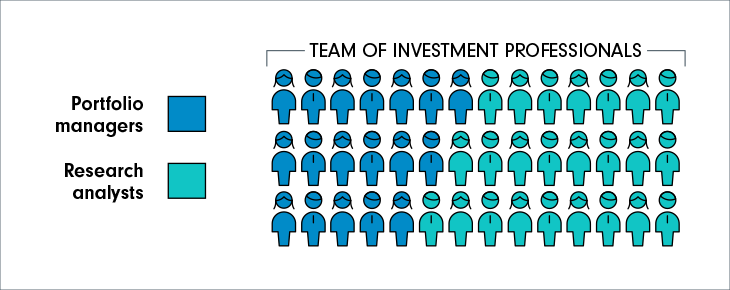

Active management means that you have a team of investment professionals constantly working to maximize your investment return. The team is composed of portfolio managers, the ones who run the fund, and research analysts, who are constantly scanning the markets and finding new companies.

What is the value of active management?

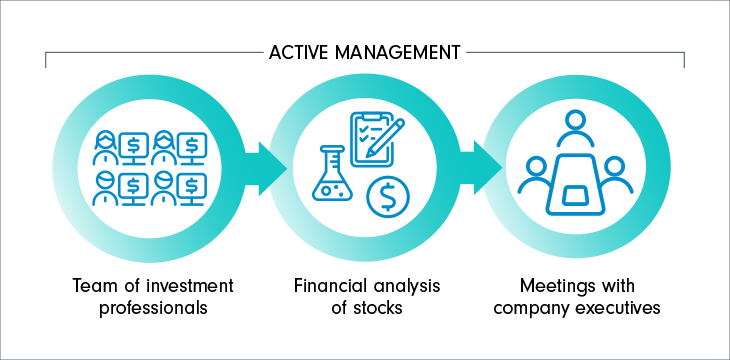

As you can see in the diagram below, there are real people selecting the individual securities to invest in on a case-by-case basis, seeking to outperform broader market indexes (e.g., the S&P/TSX Composite Index). The investment teams are meeting with executives of the companies they are invested in and are considering investing in.

They thoroughly analyze companies’ financial statements and business models, and also meet with the executive teams and review their strategies to see if a company has the right leadership and direction to be successful. The dynamics of active management are shown below:

The team of investment professionals use broad market indexes as their benchmarks for performance. Portfolio managers are proactively trying to generate higher returns than the index that serves as their fund’s benchmark. If they can beat the benchmark, your investments have the potential for stronger returns, which means you may get more money.

Why does active management matter during market volatility?

Think of home renovations: you can either hire a contractor with experience or do it yourself (DIY). When there’s a huge leak in the ceiling, the safest bet is to hire a professional. There is usually less risk that way than with DIY projects. In investing, actively managed funds are managed by a team of investment professionals who can proactively manage a fund during periods of volatility. That’s opposed to passively managed index funds: investing in them would rely on the performance of the markets, rather than an investment professional’s experience.

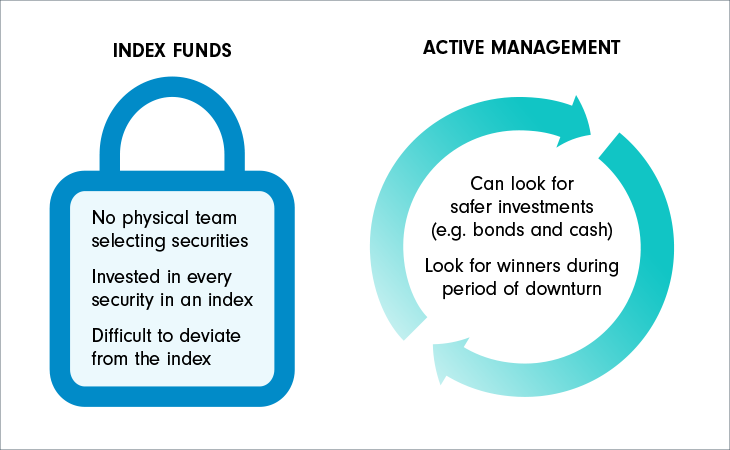

Let’s look at what happens when your investments do not have active management, which means they passively track an index. These products are also known as index funds. By tracking a broad market index, passively managed funds react to the movements of the market. But what happens when the market is not performing well? The index fund also does not perform well, which leads to one of the main benefits of having an investment team select securities that can deviate from the market: downside protection.

What are three things to remember during times of market volatility? →

What is downside protection?

Downside protection consists in the ability of investment teams to diversify their portfolio before or during downturns to protect investment returns. Broad market index funds are invested in all the securities listed in an index, while actively managed funds are invested in securities selected by the investment team. Investment teams can continuously invest in lower-risk securities, so they are prepared for downturns. They can also focus on top performing securities that may be less impacted in comparison to a broad market index. Once markets start to decline, investment teams can move money into lower-risk investments, such as bonds, or move to cash. We measure downside protection by comparing the performance of a fund to its benchmark during a market downturn. Downside protection is one of the reasons why it might be better to stay invested during periods of market volatility than to make impulsive decisions.

Let’s compare the downside protection offered by active management and passive index funds:

Check out these three charts on the benefits of staying invested →

What does Fidelity’s active management look like?

Fidelity uses a global network of research analysts who are constantly scanning the markets to find new investment opportunities and identify potential risks.

Get the star treatment

See the complete list of our Morningstar five-star rated funds.